|

Duncan Wallace The article “Tough love: budget on track to fix debt” by Evan Lacey which was published two weeks ago was highly misleading. It asserted that the Government had made “tough and unpopular decisions designed to repair Australia’s finances”, and whilst the government’s decisions may be tough and unpopular, they are not being made to repair Australia’s finances. It is true that government expenditure as a percentage of GDP has dropped 0.6% in this budget, but it must be kept in mind that Joe Hockey mysteriously gave close to $9 billion to the Reserve Bank of Australia (RBA) at the end of last year, and spent another $3 billion on other bits and bobs. These discretionary additions to last year’s budget might cynically be attributed to the Liberal Party attempting to give the impression that it is cutting spending when it is not. If you take off $10 billion from last year’s expenditure, just over the amount given to the RBA, but under the total discretionary additions, expenditure as a percentage of GDP is exactly the same as this year: 25.3%, which equates to no net cuts.

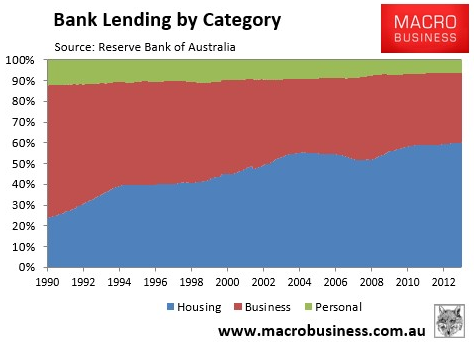

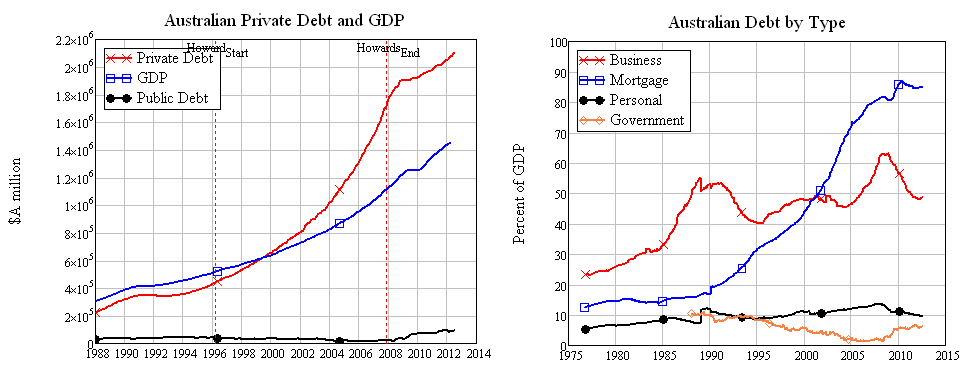

Last year, Wayne Swan forecast spending this year would be $415 billion under a hypothetical Labor government. Under Joe Hockey, it is $415 billion. Wayne Swan also forecast a deficit this year of $11 billion under Labor’s plans. Joe Hockey’s deficit: $26 billion. Is this an anomaly, wherein the Liberals have been fiscally careless but their supporters have not noticed because of expectations induced by their fiscally conservative history? Or is something else going on? To get a good idea of this, we might first look internationally to conservative idols Reagan and Thatcher. Both were lauded for their stance on small government, with the low spending and low taxation this is supposed to involve. But if we look, first, at the Thatcherite Government, we find that in its seventeen years of power, government expenditure as a percentage of GDP was an average of 43.5%, almost exactly the same as the 17 years immediately beforehand, which was 43.6%. Reagan, it turns out, was even worse at doing small government: he increased government debt more than any other post-WW2 president until George W Bush, tripling gross federal debt from $900 million to $2.7 billion. And conservatives in Australia? The IMF – which The Australian this weekend approvingly held as having “no political axe to grind” – made a detailed study recently of government spending over the last 200 years. It identified only two periods of Australian reckless “fiscal profligacy” in the last fifty years: the first in 2003, and the second between 2005 and 2007 – both under the Howard Coalition government. All this is not to say, however, that Labor is any more responsible than the Liberals. Rather, it is to point out that the differences between the two parties are marginal, at best. Their policies are almost exactly the same, and their taxing and spending histories also. Marginal differences can make a very big difference to the most vulnerable in society, however. Cuts to unemployment benefits for under 30s in this year’s budget are breathtaking, and will only lead to more crime as an already stressful life becomes desperate. Similarly, a $500 million cut from Aboriginal welfare, at the same time as an extra $70 million is spent on policing them, will mean Aboriginal contact with the law will only increase. What’s more, Legal Aid has been cut by $15 million. This when Aboriginal people are already the most incarcerated race on earth, and Aboriginal children are being taken from their parents at a higher rate today than they were at the peak of the stolen generation. Lacey is correct, however: we do have a debt problem, and we are at risk of another global financial crisis. The crisis was caused by high private debt, and in Australia, it’s higher than ever. Government debt is completely dwarfed by private debt. This is largely because investment has been increasingly left to financial markets as a result of deregulation and the privatisation of public assets over the last 30 years. It turns out financial markets are terribly inefficient at investing in anything productive, and mostly end up just inflating asset prices, resulting in an increase in debt. This budget continues those policies, with the deregulation of student fees entailing their rapid increase, and, with HECS debt to be charged a real rate of interest, student debt is set to at least double. This seems to be a first step towards privatising student debt - laying the ground by first making it more attractive to financial markets – something which Christopher Pyne has said “wouldn’t be insensible”. What’s more, $7 GP co-payments are to be funnelled into the financial markets via a $20 billion research fund, and states are being encouraged to privatise more state assets in order to deal with budget short-falls exacerbated by federal funding cuts of $80 billion to hospitals and schools. It is likely states will be compelled to lobby for an increase in the GST, too, with Tim Costello this weekend advocating for it to be expanded to cover fresh food, water and health. An increase in the regressive GST tax would go along with a second, underhand increase in taxes, which is also regressive. The Australian Financial Review states, “The single biggest boost to the budget bottom line over the next four years will come from so-called bracket creep – which sees growth in Commonwealth coffers grow automatically as taxpayers see their inflation-driven wage hikes push them into higher tax brackets… According to Grattan Institute director John Daley, bracket creep means by 2017-18 taxpayers – particularly those on middle incomes – will be slugged an extra $18 billion a year and rising.” This extra revenue, plus the savings made from reducing spending on those who need it, is being used for tax cuts for corporations, the abolition of the carbon tax and the resource rent tax, as well as increasing spending on defence. The Australian, this weekend, after outlining some of the ways the government is trying to hide the increase in spending on defence, stated they were using such measures because “presumably the Abbott government does not want people saying it took money from the unemployed to spend on defence”. However people should be saying so, because they are. All this is very problematic, particularly since Australia desperately needs massive investment in renewable energy, public transport, and high speed rail, but neither party is at all willing to deliver. A significant cause of this is that the media in Australia is very highly concentrated, with three corporations controlling 98% of print media. As such, a very particular agenda can be pushed, which may be completely at odds with what ordinary people want. An obvious example is the NBN, which enjoyed massive public support, but for reasons which we can only speculate, received “overwhelmingly negative” print coverage, and has successfully been cut back by the Liberals. Worryingly, the government is now also reducing funding to the ABC, and Malcolm Turnbull has flagged more media deregulation. Media concentration is only going to increase further. As such, our situation is very similar to that in America, where a recent Princeton study found that “the preferences of the average American appear to have only a minuscule, near-zero, statistically non-significant impact upon public policy.” What does have impact though is big money. That is, unless we do something about it. Duncan Wallace is a 1st year JD student; he has no official political affiliations. REFERENCES [1] http://www.theguardian.com/business/grogonomics/2014/may/13/budget-2014-the-six-graphs-that-matter-for-australia [1] Calculations made myself, stats taken from here: http://www.afr.com/data/budget.aspx?budgetId=2014-15&&dimensions=wide [1] https://newmatilda.com/2014/05/13/rich-and-rhetoric-won-day [1] https://newmatilda.com/2013/05/14/swan-delivers-fails-sell [1] Calculations made myself, stats taken from here: https://docs.google.com/spreadsheet/ccc?key=0AonYZs4MzlZbcGhOdG0zTG1EWkVOQzNJMHM3QXZIQlE#gid=0 [1] http://en.wikipedia.org/wiki/History_of_the_United_States_public_debt [1] http://www.theaustralian.com.au/national-affairs/in-truth-our-debt-growth-faster-than-europes/story-fn59niix-1226920839651#mm-premium [1] http://www.smh.com.au/federal-politics/political-news/hey-big-spender-howard-the-king-of-the-loose-purse-strings-20130110-2cj32.html [1] http://www.ipa.org.au/library/publication/1367829888_document_paper_-_australias_big_government_-_may_2013.pdf [1] http://www.sbs.com.au/news/article/2014/05/14/indigenous-affairs-hit-savage-budget-cuts [1] http://www.lawcouncil.asn.au/lawcouncil/images/LCA-PDF/mediaReleases/1412_--_Chronically_underfunded_legal_aid_commissions_suffer_further_cuts_in_federal_budget.pdf [1] http://www.treatyrepublic.net/content/there-more-behind-21-years-spiralling-indigenous-incarceration-rates [1] http://tracker.org.au/2014/03/the-lost-generations/ [1] Graphs taken from: http://www.businessspectator.com.au/article/2012/8/27/interest-rates/abbotts-not-so-golden-years [1] http://www.abc.net.au/money/currency/features/feat3.htm [1] Graph taken from: http://www.macrobusiness.com.au/2014/02/its-housing-thats-killing-productivity/ [1] http://www.smh.com.au/federal-politics/political-news/higher-student-debts-will-hit-chance-of-buying-home-20140516-38ffy.html [1] http://www.abc.net.au/news/2013-10-28/pyne-wont-rule-out-privatising-hecs-debt/5051194 [1] http://www.theguardian.com/world/2014/may/13/budget-2014-joe-hockey-delivers-deep-pain-for-little-gain [1] http://www.theaustralian.com.au/national-affairs/welfare-leaders-back-gst-reform/story-fn59niix-1226920835953#mm-premium [1] http://www.afr.com/p/national/budget/hockey_takes_the_slow_road_to_fiscal_ZccL9Ez038xWzKM2GYYIgP [1] http://www.theaustralian.com.au/opinion/columnists/no-more-funny-money/story-e6frg76f-1226920644409#mm-premium [1] http://theconversation.com/australias-lamentable-media-diversity-needs-a-regulatory-fix-12942 [1] http://delimiter.com.au/2014/02/10/nbn-enjoys-massive-public-support-despite-overwhelmingly-negative-print-coverage/ [1] http://www.abc.net.au/news/2014-03-09/cross-media-ownership-rules-due-for-rethink-malcolm-turnbull/5308550 [1] http://www.policymic.com/articles/87719/princeton-concludes-what-kind-of-government-america-really-has-and-it-s-not-a-democracy?utm_source=policymicFB&utm_medium=main&utm_campaign=social

Evan Lacey

27/5/2014 10:38:42 am

My article asserted that the Federal Government was taking tough measures designed to improve Australia's finances. I stand by that assertion.

Jim McGarvie

28/5/2014 03:44:15 am

Duncan, this is a commendable and enlightened critique, thanks.

Duncan Wallace

31/5/2014 02:45:45 pm

I'm impressed by your commitment to the cause Evan, and I hope the Liberal party rewards your efforts. But even you know, surely, that we are witnessing one of the biggest attacks on the general population in the post-war period, and that it should not be stood for! #blockthesupply Comments are closed.

|

Archives

October 2022

|